CM Free Laptop Yojana 2024 : Benefits, details & How to apply

Sukanya Samriddhi Account Scheme

INTRODUCTION of Sukanya Samriddhi Yojna

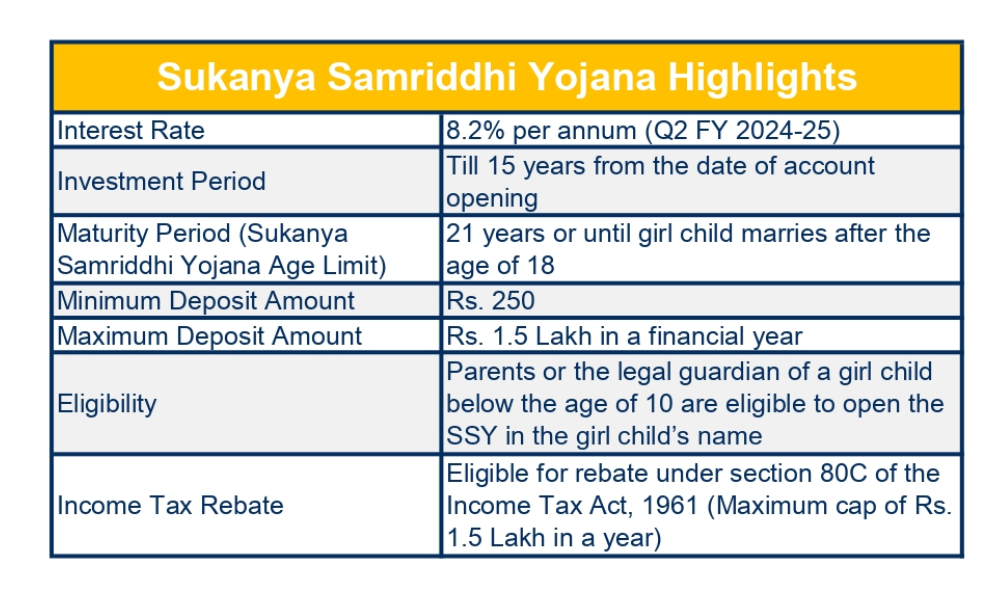

- Minimum deposit ₹ 250/- Maximum deposit ₹ 1.5 Lakh in a financial year.

-

Account can be opened in the name of a girl child till she attains the age of 10 years.

-

Only one account can be opened in the name of a girl child.

- Account can be opened in Post offices and in authorised banks.

-

Withdrawal shall be allowed for the purpose of higher education of the Account holder to meet education expenses.

-

The account can be prematurely closed in case of marriage of girl child after her attaining the age of 18 years.

-

The account can be transferred anywhere in India from one Post office/Bank to another.

-

The account shall mature on completion of a period of 21 years from the date of opening of account.

-

Deposit qualifies for deduction under Sec.80-C of I.T.Act.

-

Interest earned in the account is free from Income Tax under Section -10 of I.T.Act.

Sukanya Samriddhi Yojana Details

What is Sukanya Samriddhi Yojana?

Sukanya Samriddhi Account is a savings scheme designed by the Government of India which helps in financial stability for girl child’s education and marriage. This scheme encourages the parents of every girl child to save money and accumulate funds for her beneficial future.

How much amount will I get in Sukanya Samriddhi Yojana?

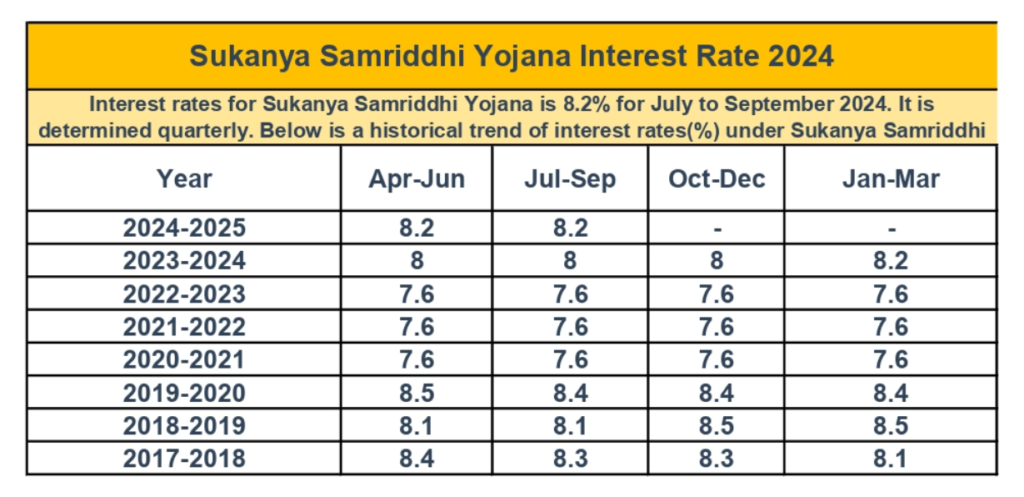

Maturity amount entirely depends on the yearly contributions made to Sukanya Samriddhi Account. The interest earned on the account is 8.2%, but the Government of India decides Sukanya Samriddhi Yojana interest rate from time to time. parents of every girl child to save money and accumulate funds for her beneficial future.

What are the rules of Sukanya Samriddhi Yojana?

Sukanya Samriddhi Yojana Plan has a set of rules laid out by the Government of India. They include :

Minimum deposit of Rs. 250 per month and a maximum of 1.5 lakhs.

Rate of Interest- 8.2% p.a. (subject to change as per quarterly guidelines from GOI).

The account shall mature after completion of 21 years from the date of opening a Sukanya Samriddhi account.

Parents or a guardian will operate the account till the child completes 18 years of age.

What are the benefits of Sukanya Samriddhi Yojana?

Under Sukanya Samriddhi Yojana, parents of the girl child can avail some unique benefits which include – Highest interest rates among all savings schemes, financial security and stability provided to the girl child, and benefits under Section 80C of the Income Tax Act, 1961. You can avail tax benefits under.

How to open Sukanya Samriddhi account online?

A means of opening Sukanya Samriddhi Yojana account through online medium is being developed.

What is the eligibility for Sukanya Samriddhi Account?

A girl child who is a resident of India and her age is between 0-10 years is eligible to open Sukanya Samriddhi Account. Parents can open the Sukanya Samriddhi Yojana account of the girl child by going to the post office or bank and providing the necessary documents.

How does Sukanya Samriddhi Account work?

Sukanya Samriddhi Account can be opened by the parents of any girl child between the age of 0-10 years. / It can be continued till maturity i.e. 21 years from the date of opening the account under Sukanya Samriddhi Yojana. Withdrawal of upto 50% of the deposit amount is allowed at the age of higher education. In case of marriage, the account can be closed prematurely after attaining the age of 18 years.

What documents are required to open a Sukanya Samriddhi Account?

To open a Sukanya Samriddhi Account at any bank or post office, submit the account opening form, KYC compliance documents of legal guardian or parents and documents including birth certificate of the girl child.

Sukanya Samriddhi Yojana Interest Rate in 2024

What is the age limit for Sukanya Samriddhi Yojana (SSY)?

The age limit is determined by the National Savings Institute (NSI) which is between 0-10 years.

What happens if I deposit more than Rs. 1.5 lakh in Sukanya Samriddhi Yojana (SSY)?

If the deposit exceeds Rs. 1.5 lakh in a year, it will be excluded from the SSY scheme deposits for a financial year.

For how many years can I deposit in Sukanya Samriddhi Account?

Parents or legal guardians can deposit funds for 15 years from the date of opening the Sukanya Samriddhi Account.

How many times can I deposit money in Sukanya Samriddhi Yojana?

The Government of India has not put any limit on the frequency of deposits, but the amount paid in Sukanya Samriddhi Yojana should be in multiples of Rs. 50.

What is the best time to deposit money in Sukanya Samriddhi Account?

Ideally, deposit can be made at any time in a month, but it will be more beneficial for the account holder if the deposit in SSA is made before 5th of every month. As interest will be calculated on the lowest balance in the account between the end of the calendar month i.e. 5th day and the end of that month.

When does the SSY account mature?

Sukanya Samriddhi Yojana matures after the girl child attains the age of 21 years.